Improve Your Health by Taking Advantage of Open Enrollment

There’s a lot you can do in an hour to better your health. In one hour, you can take a yoga class, make a healthy meal, or get your teeth cleaned. You can even get a massage. Keeping your health benefits in tip-top shape is another smart way to spend an hour helping to improve your physical and financial health.

There’s a lot you can do in an hour to better your health. In one hour, you can take a yoga class, make a healthy meal, or get your teeth cleaned. You can even get a massage. Keeping your health benefits in tip-top shape is another smart way to spend an hour helping to improve your physical and financial health.

Changes in health benefits can mean big changes to a family’s finances. During your company’s open enrollment period, spend an hour reviewing your health plan options so you can make smart, informed choices when it comes to your health and finances.

When it comes to making the most of your health benefits, here is some advice from Susan Kosman, Aetna’s chief nursing officer, and Tracey Baker, a Certified Financial Planner professional. They came up with four easy steps, available at http://www.besmartaboutyourhealth.com, to help you skip the stress, avoid the confusion, and get your health plan working for you in 60 minutes or less.

Prioritize

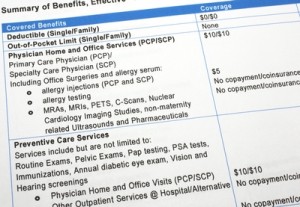

What is most important for the health and wellness of you and your family? Maybe it’s the cost of prescription drugs. Perhaps it’s being able to see out-of-network doctors. It could be dental or vision exams – or even discounts on wellness services like gym memberships. Assess your family’s health priorities and look for plans that cover these services.

Calculate

Tracking what you spend is a great way to make better choices about your health benefits. You wouldn’t buy a car without comparing it to other models and knowing what it would cost a month, would you? Follow these steps to ensure you are getting a health plan that works for you and won’t break your piggy bank:

Make sure you can afford the premiums. The health reform law passed by Congress aims to keep premiums in check. No one knows what will happen when new rules go into effect in 2014. For now, be sure to pick a plan that balances your health needs and your budget.

Review last year’s medical costs. Knowing what you spent last year on health care will help you effectively plan for the coming year. If you can, set up a flexible spending account (FSA), which is exempt from most taxes, to pay for your health spending. Because FSAs are mostly tax-free, you’ll be able to keep more money in your paycheck each month. Keep in mind that health reform will put a $2,500 annual limit on your FSA by 2013.

Check annual or lifetime limits. As a result of the health reform law, insurers will stop lifetime limits this year, and will eliminate annual limits in 2014. Be sure to check if your health plan has a limit – especially if you have a chronic condition like diabetes or asthma.

Look for other ways to save. Health Reimbursement Arrangements (HRAs) and Health Savings Accounts (HSAs) are other ways to save pre-tax dollars for health expenses.

Predict

Look ahead to annual doctors’ visits or routine health screenings like mammograms or colonoscopies. Using these preventive services is a great way to save money and stay healthy.

Compare

If you have a choice between health plans, find the plan that gives the biggest bang for your buck. If you have just one option through your plan at work, or if you buy individual health benefits, make sure you use all of the services that are covered. After all, you’re paying for them. For instance, child immunizations and wellness discounts may be covered. Health care reform may make it easier to receive these types of services.

Category: Business Tips & Resources